how much does illinois tax on paychecks

Both employers and employees are responsible for payroll taxes. If they are professional administrative or executive employees however then they are only entitled to be paid out on a monthly basis.

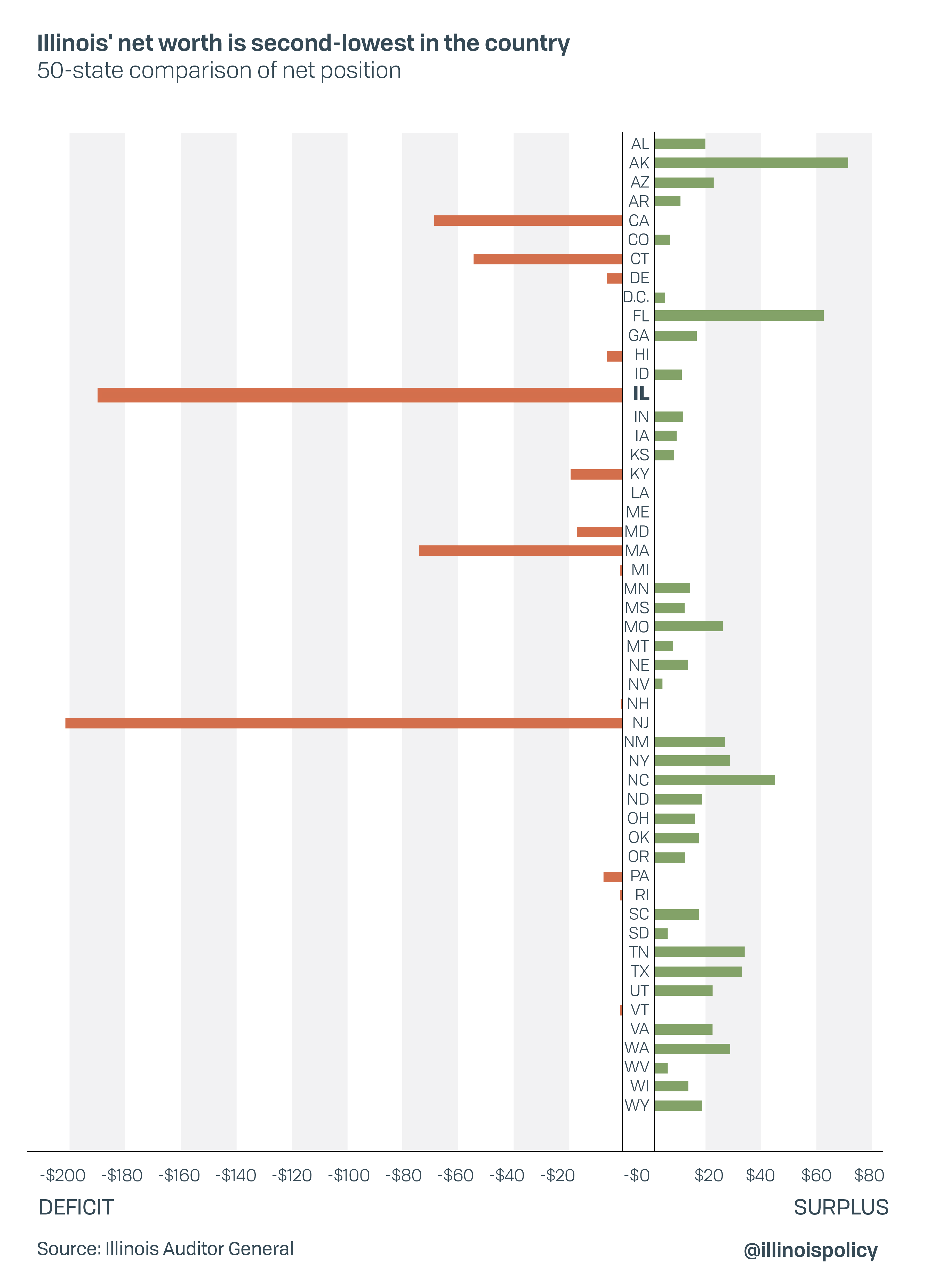

Illinois Income Tax Hikes Failed To Fix State Finances

IL-941 Illinois Withholding Income Tax Return Quarterly due either the last day of the month following the end of the quarter April 30 July 31 October 31 and January 31 or annually.

. Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy. According to the Illinois Department of Revenue all incomes are created equal. Amount taken out of an average biweekly paycheck.

Helpful Paycheck Calculator Info. Put Your Check in a Bank. The Illinois state income tax is a flat rate for all residents.

No cities within Illinois charge any additional municipal income taxes so its pretty simple to calculate this part of your employees withholding. How much does illinois tax on paychecks. Employees who file for exemption from federal income tax must still have Medicare taxes withheld from their payroll checks.

Under the Illinois Wage Payment and Collection Act an employer must pay their employees at least once every 13 days if they are regular blue collar employees. There are two state taxes to be aware of in Illinois. See Section 300730 and Section 300820.

Everyones income in Illinois is taxes at the same rate due to the states flat income tax system of 495. In most cases youll be credited back 54 of this amount for paying your state unemployment taxes on time resulting in a net tax of 06. Switch to hourly Salaried Employee.

Due the last day of the month following the end of the year January 31. It is essential to audit your paycheck for accuracy. Yes Illinois residents pay state income tax.

Newest Checking Account Bonuses and Promotions. These percentages are deducted from an employees gross pay for each paycheck. Personal income tax and unemployment tax.

Personal income tax in Illinois is a flat 495 for 20221. Youll use your employees IL-W-4 to calculate how much to withhold from their paycheck. For example an employee with a gross pay of 1000 would owe 62 in Social Security tax and 1450 in Medicare tax.

However where a deduction is to continue over a period of time. The bonus tax calculator is state-by-state compliant for those states that allow the. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our Taxpayer Assistance Division at 1 800 732-8866 or 1 217 782-3336.

If you make more than a certain amount youll be on the hook for an extra 09 in medicare taxes. Forms required to be filed for Illinois payroll are. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4. The Illinois salary calculator will show you how much income tax.

Youll use your employees IL-W-4 to calculate how much. Details of the personal income tax rates used in the 2022 Illinois State Calculator are published below the calculator. The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Employers are responsible for deducting a flat income tax rate of 495 for all employees. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. Professional administrative and executive employees as defined in.

The Waiver Request must be completed and submitted back to the Department. Personal Income Tax in Illinois. Amount taken out of an average biweekly paycheck.

Illinois employers may establish semimonthly biweekly weekly or daily pay periods for most employees 820 ILCS 1153. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income Tax Rates and Thresholds in 2022. Employers in Illinois must deduct 145 percent from each employees paycheck.

Total income taxes paid. When Does the Law in Illinois Require Paychecks to be Sent Out. No an employer cannot deduct money from your pay for cash or inventory shortages or damages to the employers equipment or property unless you sign an express written agreement allowing the deductions AT THE TIME the deduction is made.

This Illinois bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Also not city or county levies a local income tax. In Illinois the Supplemental wages and bonuses are charged at the same state income tax rate.

How Much Tax Is Deducted From A 1000 Paycheck. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois. This 6 federal tax on the first 7000 of each employees earnings is to cover unemployment.

Commissions may be paid once a month rather than semimonthly as is required for other wages. Employees who file for exemption from federal income tax must still have medicare taxes. Paid by the hour.

Unlike Social Security all earnings are subject to Medicare taxes.

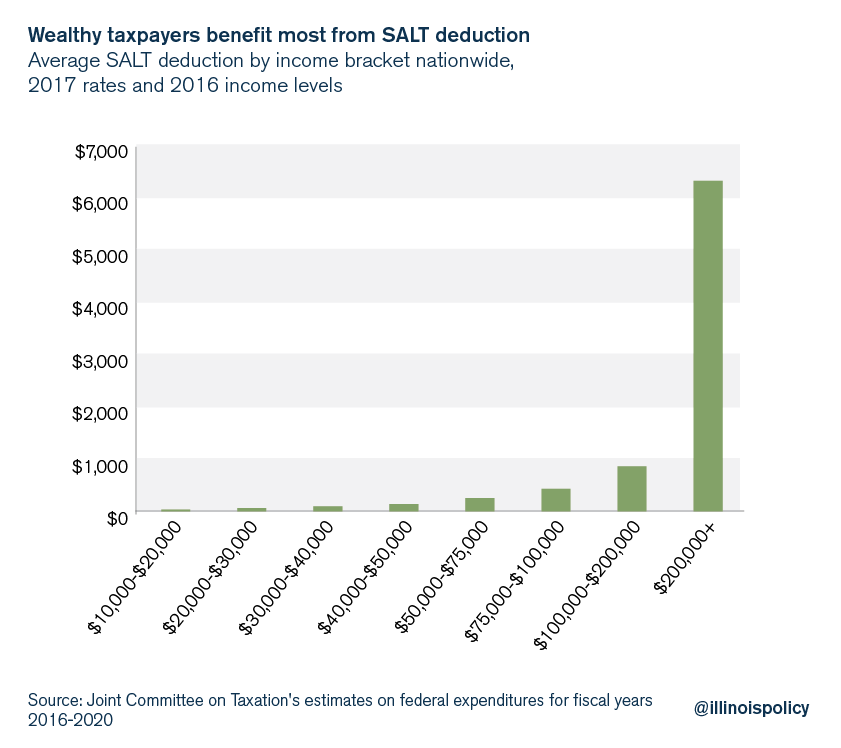

Irs Moves To Block Illinois Lawmakers Tax Credit Workaround Scheme

Ken Griffin Citadel Hq Departure Will Hit Illinois Tax Revenue Crain S Chicago Business

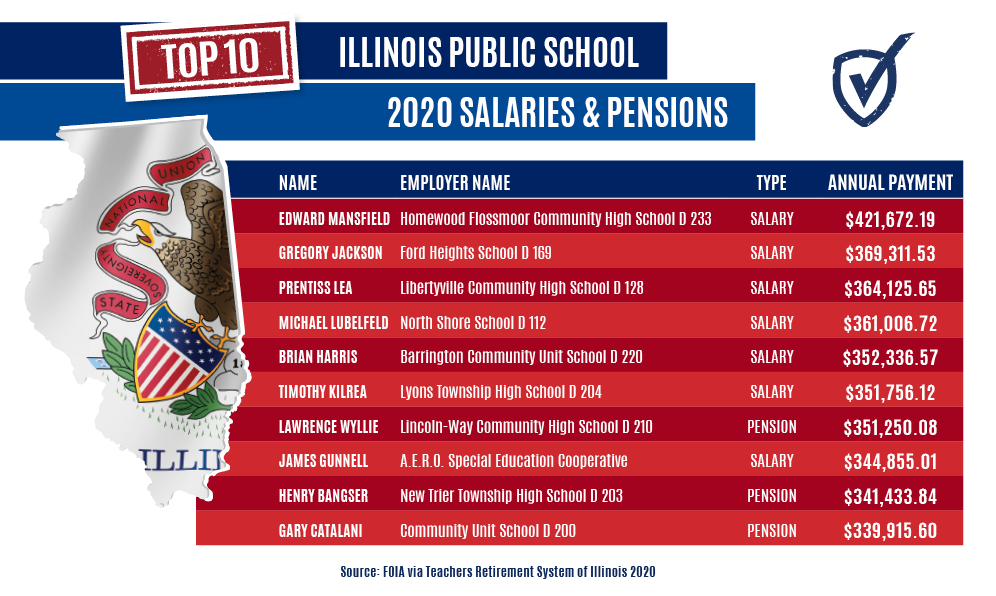

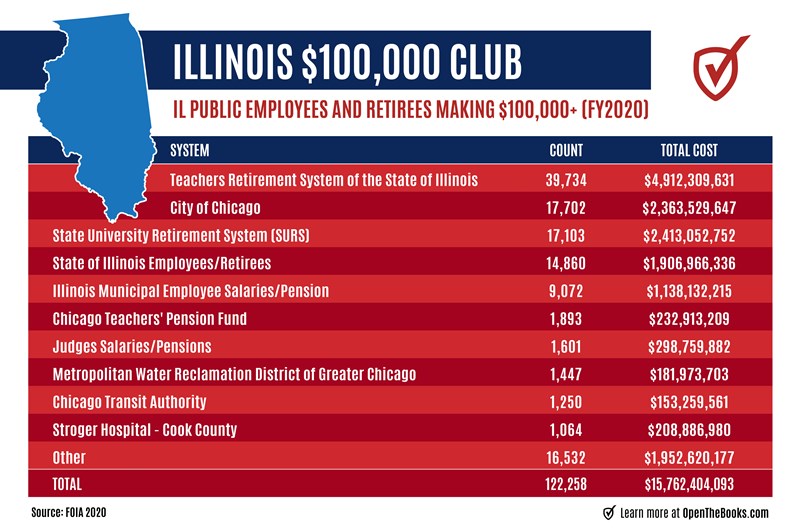

Forbes Why Illinois Is In Trouble 122 258 Public Employees Earned 100 000 Costing Taxpayers 15 8 Billion Despite Pandemic Charts News Open The Books

Motivational Print Art Inspirational Quotes Wall Art Runner Painting Digital Inspirational Quote Prints Inspirational Quotes Wall Art Art Quotes Inspirational

Ides Overpayment Waiver Illinois Allows Unemployed To Apply For Overpayment Waiver To Keep Money Abc7 Chicago

Raymond J Busch Ltd Now Serving You From Two Locations 13011 S 104th Ave Suite 200 Small Business Accounting Services Business Accounting Information

Democrats Reach Deal On 1 8 Billion In Tax Breaks With Direct Checks To Most Illinoisans

Some Illinois Pua Unemployment Benefit Recipients Told To Pay Back Thousands Of Dollars To Ides In Alleged Over Payment Abc7 Chicago

Reminder Individual Income Tax Quarterly Estimated Payment Due Date Is June 15

Best Representation Descriptions Does Walmart Cash Cashiers Checks Related Searches Auto Insurance Claim C Credit Card Design Money Template Payroll Template

Illinois Payroll Tax Guide 2022 Cavu Hcm

Forbes Why Illinois Is In Trouble 122 258 Public Employees Earned 100 000 Costing Taxpayers 15 8 Billion Despite Pandemic Charts News Open The Books

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Irs Moves To Block Illinois Lawmakers Tax Credit Workaround Scheme